Payee Details - Taxpayer Information

Before you can enroll in ePay, you must first complete the Tax Information form.

Before you can enroll in ePay, you must first complete the Tax Information form.

ACH regulations require that ISS knows that we are sending money to the correct person or organization. The way to do that is with a W-9, which is what our Tax Information form is.

Completing this form does not mean you will receive tax documents from ISS unless you are providing services that require a 1099. The IRS requires that ISS has proof of who you are so that we do not have to withhold money for taxes.

If you provide services that require a 1099, you must complete the Tax Information form in order to receive payment for those services.

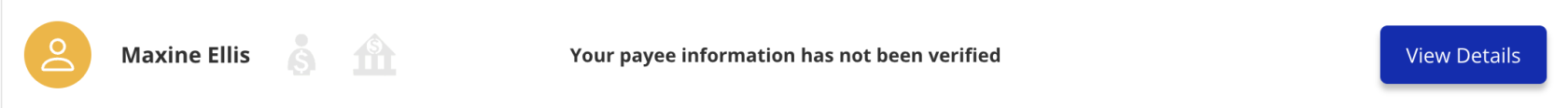

From the My Expenses page, select View Details to begin enrollment.

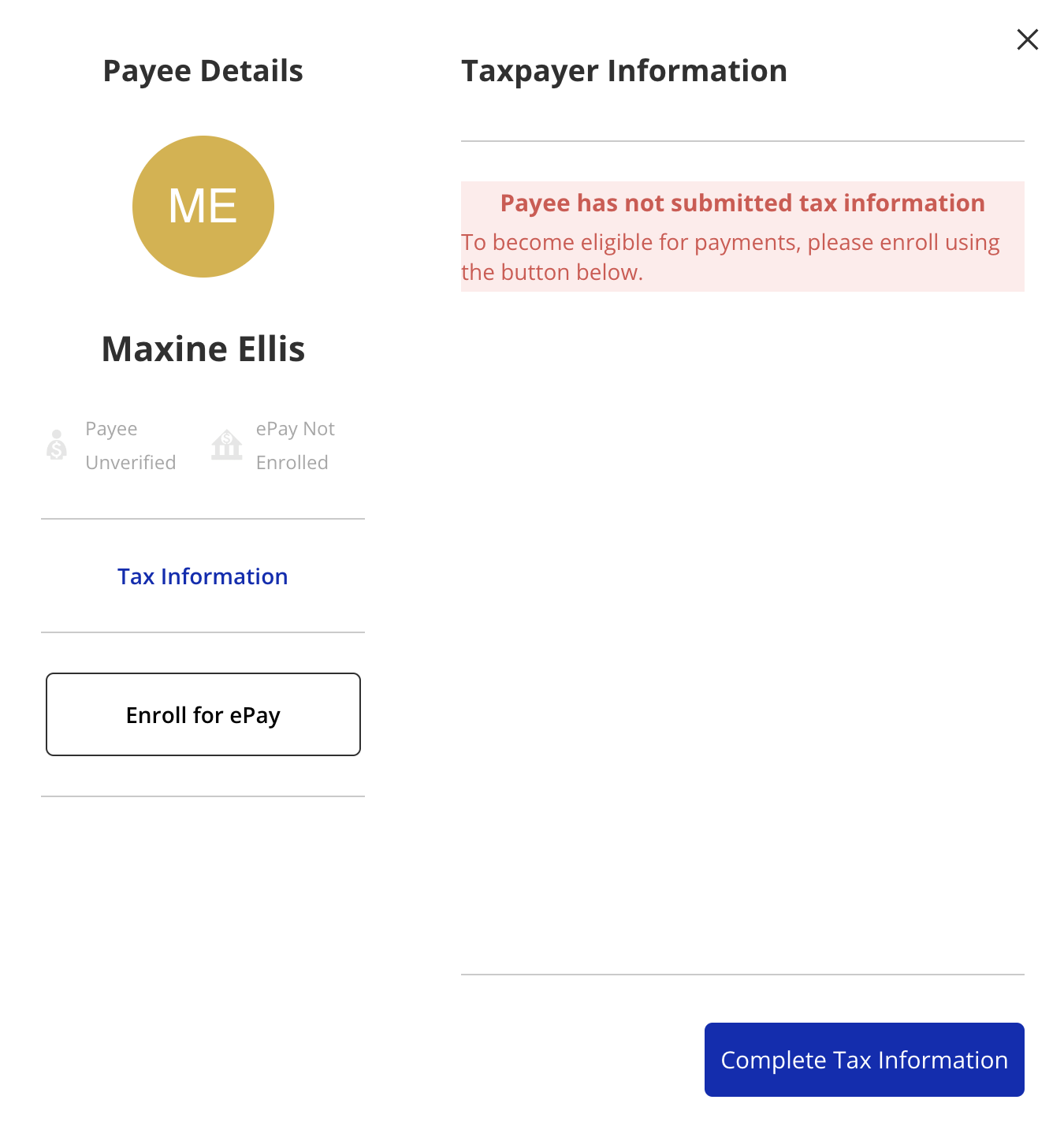

Once the Payee Details window appears, click the blue Complete Tax Information button at the bottom right of the screen to begin filling out the Tax Information form.

ISS Staff are unable to assist you with the completion of your tax information form. Visit the IRS website at https://www.irs.gov/forms-pubs/about-form-w-9 for more information and contact your tax or accounting professional if you have any questions.

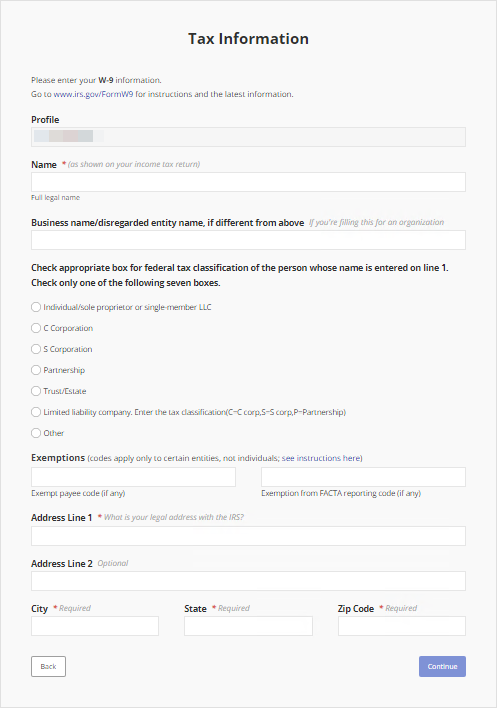

Fill out the form and select Continue on the bottom right to advance to the next page.

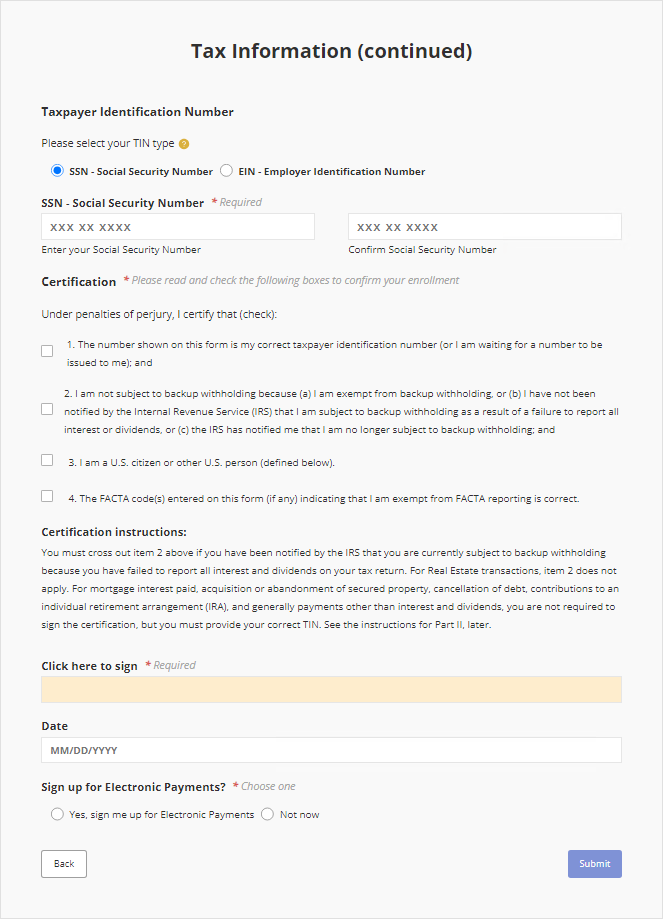

Complete the second page of the form. Once finished, click Submit at the bottom right of the page.

Once you submit the Tax Information form

The IRS will validate the information you provided on the form. If your information matches the IRS' records, your Payee Tax status will change to verified on the Portal.

This usually happens very quickly, but it does depend upon the IRS' e-Services availability, how many times you have tried to submit your information, and how many requests have been made from ISS that day.

Tips and More Info

- The Profile showing at the top of the form is automatically entered based on what ISS has in our system for you. That information is not sent to the IRS.

You will not be enrolled to receive electronic payments until both the Tax Information and Electronic Payment Setup forms are completed and they are both verified as valid.

Updated 07/02/24

Disclaimer: All names displayed in the above screen shots are fictional characters. No identification with actual persons (living or dead) is intended or should be inferred.